The smart Trick of How Does Medigap Works That Nobody is Discussing

Table of ContentsNot known Incorrect Statements About What Is Medigap The smart Trick of How Does Medigap Works That Nobody is Talking AboutGetting The What Is Medigap To WorkThe 2-Minute Rule for MedigapThings about How Does Medigap WorksThe Basic Principles Of How Does Medigap Works

A (Lock A locked lock) or implies you've securely linked to the. gov internet site. Share sensitive details only on official, safe and secure websites.What truly amazed them was the understanding that Medicare would not cover all their healthcare costs in retired life, consisting of those when traveling abroad. "We take a trip a great deal and also want the protection of knowing we can obtain medical therapy far from home," states Jeff, who with Alison is looking forward to seeing her household in England.

"Talk to your medical professional about aging and take a look at your family history," claims Feinschreiber. Given that there is no "joint" or "family members" insurance coverage under Medicare, it may be a lot more expense efficient for you as well as your spouse to select various protection choices from separate insurance coverage firms.

8 Easy Facts About How Does Medigap Works Shown

The Ottos understand that their requirements may change gradually, specifically as they cut travel strategies as they age. "Although we've seen expenses enhance over the last 2 years because we enrolled in Medigap, we have the best degree of additional coverage for currently and also think we're obtaining great worth at $800+ each month for the both people including dental insurance coverage," stated Alison.

For residents in select states, sign up in the right Medicare strategy for you with help from Fidelity Medicare Providers.

Not every plan will certainly be offered in every state. Medicare Supplement Insurance is marketed by exclusive insurer, so the cost of a plan can vary between one carrier or place as well as another. There are a couple of other points that might impact the cost of a Medigap plan: The amount of insurance coverage offered by the strategy Whether or not clinical underwriting is utilized as part of the application procedure The age at which you sign up with the strategy Eligibility for any kind of price cuts offered by the service provider Sex (females commonly pay much less for a plan than men) In order to be qualified for a Medicare Supplement Insurance coverage plan, you need to be at least 65 years of ages, registered in Medicare Component An and also Component B as well as reside in the location that is serviced by the strategy.

How Does Medigap Works Fundamentals Explained

You are enlisted in a Medicare Benefit or Medigap strategy offered by a business that misguided you or was located to have not followed specific regulatory policies. Medicare Supplement strategies and also Medicare Benefit plans job really differently, and you can't have both at the exact same time. Medicare Supplement prepares work alongside your Initial Medicare insurance coverage to aid cover out-of-pocket Medicare prices like deductibles and also coinsurance.

Lots of plans additionally offer other advantages such as prescription drug coverage or dental treatment, which Original Medicare doesn't commonly cover. Medicare Supplement strategy costs can vary based upon where you live, the insurer offering plans, the rates framework those business make use of and the sort of strategy you request.

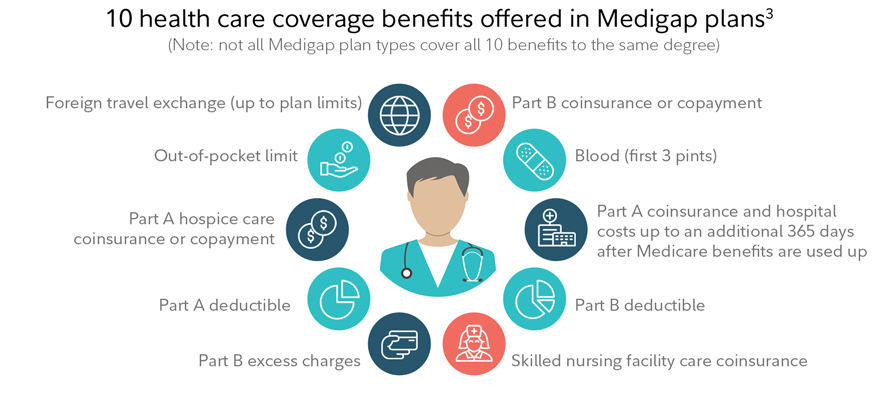

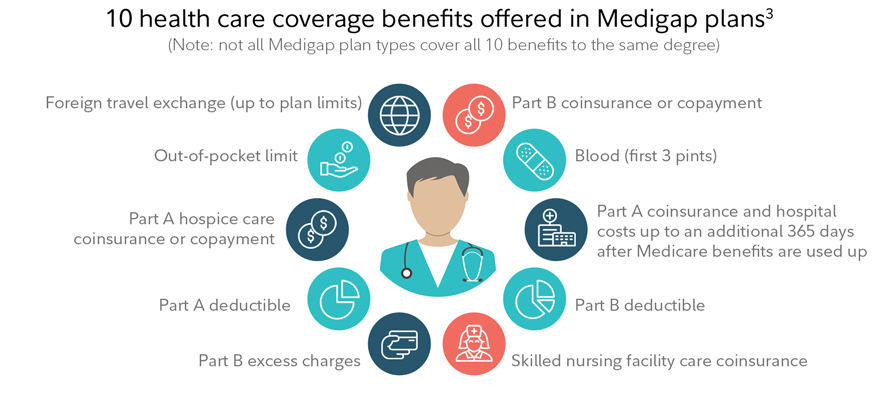

The average monthly costs for the very same plan in Iowa in 2022 was have a peek at this website just $120 monthly. 1 With 10 various kinds of standardized Medigap plans and a variety of advantages they can use (in addition to the series of monthly premiums for each and every strategy), it can be helpful to make the effort to compare the Medigap alternatives offered where you live - Medigap benefits.

A Biased View of Medigap Benefits

You need to think about switching over Medigap plans throughout specific times of the year, however. Changing Medicare Supplement intends throughout the best time can aid protect you from needing to pay higher premiums or being denied insurance coverage as a result of your pop over to this web-site health or pre-existing conditions. There are a variety of various Medicare Supplement Insurance provider across the country.

You can find out more regarding them by contrasting firm scores and also reading consumer evaluations. Medigap Plan F covers more out-of-pocket Medicare costs than any type of other standardized type of Medigap plan. For their month-to-month costs, Plan F recipients recognize that every one of their Medicare deductibles, coinsurance, copays and also various other out-of-pocket prices will be covered.

com that instruct Medicare recipients the finest methods for browsing Medicare (What is Medigap). His posts are reviewed by thousands of older Americans each month. By far better recognizing their healthcare coverage, readers might hopefully find out just how to limit their out-of-pocket Medicare costs and access high quality clinical care. Christian's enthusiasm for his duty stems from his need to make a difference in the senior neighborhood.

How Does Medigap Works for Dummies

Throughout that time framework, insurer are typically not allowed to ask you any type of wellness concerns (likewise called clinical underwriting). Afterwards, you could need to answer those inquiries, and also the answers might bring about a greater costs or to being decreased for Medigap protection. A like this couple of exemptions exist.

However, this is true just if they drop their Medicare Benefit protection within year of subscribing. Note: If you and your spouse both get Medigap plans, some insurance policy carriers will certainly provide a house discount rate. That depends upon the plan you select. Medigap has 10 standard insurance policy plans that are recognized with letters of the alphabet: Strategies A, B, C, D, F, G, K, L, M and N.

Nonetheless, within each plan, the benefits are the very same due to the fact that they are standardized. A Strategy A policy will have the exact same advantages no matter what insurance coverage company you acquire it from. So, the trick is to figure out which plan provides benefits that are crucial to you. Then you can compare deals from insurance company to insurance company to locate one of the most budget friendly price for the strategy you want.